导 读

In 2018, according to the statistics of the market for true lithium research, lithium-ion batteries in the power tool market have basically replaced other secondary batteries such as nickel-cadmium batteries and nickel-hydrogen batteries. With the development of power tools, miniaturization and light weight have been developed. The trend of cordlessness has made lithium batteries develop very rapidly in the field of power tools.

A power tool is a tool that is held by a hand and is powered by a small-power motor or an electromagnet. The tool that drives the working head through the transmission mechanism can be classified into a conventional electric type (with rope) and a rechargeable type according to the type of power ( Cordless) Before 2010, corded power tools have dominated the market due to their mature production technology and low cost, while the market for cordless power tools started relatively late, but with downstream miniaturization The convenience of demand, and the gradual reduction of battery costs, make the development of cordless power tools faster and faster, from about 30% of the total power tool production in 2011 to nearly 50% in 2018, the development is very rapid.

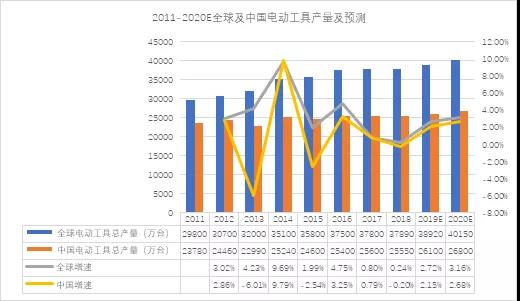

2011-2020E Global

And China's power tool production and forecast

数据来源:国家统计局,真锂研究

From the global and China's total output, the overall demand growth rate of the downstream is gradually stabilizing. The application of lithium batteries in power tools should have a relatively good growth within 5 years. The main reasons are two points. One is electric The trend of miniaturization and convenience of tools, and the development of lithium batteries on power tools from 3 strings to 6-10 strings, the increase in the number of individual products will also bring a large increase, and some power tools There is also a spare battery.

In addition to the market demand, lithium-ion power tools have also received support from some countries in terms of policies. In January 2017, the EU issued a new regulation, the nickel-cadmium battery used in wireless power tools will be fully delisted in the EU; in November 2017, according to the industry standard issued by the Ministry of Industry and Information Technology of China, China initiated electric Tools for lithium-ion battery and battery pack specifications for comments.

2011-2020E Global

And China's power tools lithium battery installed capacity and forecast

数据来源:真锂研究

From the perspective of total installed capacity, the compound growth rate of global and Chinese installed capacity from 2011 to 2018 reached 44% and 41% respectively, and the speed exceeded the increase of power tool output. In 2018, the global demand for lithium battery for electric tools was 7.26GWh. In the next few years, the growth rate of installed capacity will remain at around 10%, and will stabilize until 2025.

At present, the application of cordless power tools is mainly in the European and American markets, and the competition pattern of the industry is relatively stable. Large enterprises such as Makita, Black & Decker, Chuangke, Ph.D., and Baoshide occupy the main market share. Most of them use Samsung SDI and LG Chem. The cylindrical lithium battery of Korean companies and the domestic supplier Jiangsu Tianpeng (TENPOWER) have the most outstanding shipments.

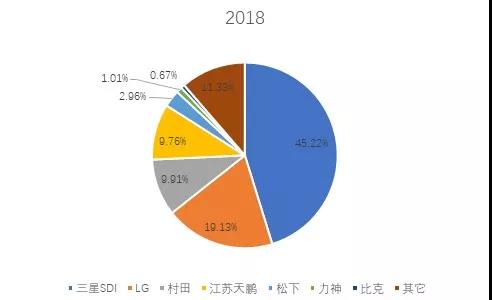

2017 global power tool lithium battery installed share

Global power tool lithium battery installed share in 2018

Judging from the global installed capacity of lithium battery companies, the top four are Samsung SDI, LG Chem and Murata, and Jiangsu Tianpeng (TENPOWER), which accounted for 84% of the total in 2018. TENPOWER, accounting for 9.76% in 2018.

From the perspective of the growth rate of the proportion, from 2017 to 2018, among the top five companies, except LG Chemical and Jiangsu Tianpeng (TENPOWER), the rest of the market share has declined slightly, the largest increase is Jiangsu Tianpeng (TENPOWER) ), rising from 6.52% to 9.76%, and achieving shipments of 708.9MWh in 2018. Jiangsu Tianpeng (TENPOWER) realized the large-scale stable production of NCA high-nickel system as early as the end of 17 years, and has passed the verification of international big brands, while other manufacturers have not yet entered the arena.

There are still some misunderstandings on the lithium battery used in power tools. It may be considered that the power battery technology for automobiles is a higher, finer and sharper technology. In fact, lithium batteries used in power tools need to meet the requirements of extreme high and low temperature environments. It is very challenging to use high-performance, high-magnification batteries because it is suitable for strong vibration, fast charge and fast release, and the protection design is relatively simple. These requirements are not lower than the vehicle power battery. It is precisely because of these harsh conditions that until recently, the international power tool brand began to use domestic lithium batteries in batches after years of verification and verification. At present, the main customers of Jiangsu Tianpeng (TENPOWER) power tools are Bosch, Black & Decker, Chuangke, etc. In addition to Jiangsu Tianpeng (TENPOWER), all of them have entered the top three international customers, and other manufacturers have made small achievements. In addition to Jiangsu Tianpeng, there are several lithium-ion enterprises in China that have entered the supply chain of international power tool giants. At the same time, many power battery companies have begun to lay out the lithium battery market for power tools. However, due to the high requirements of batteries for power tools, The certification phase is relatively long, so most of them are not among the power supply companies with large international shipments.

Although lithium batteries have broad prospects in the power tool market, they are superior to power batteries in terms of selling price (10% higher than power batteries), profit and remittance speed, but the choice of international power tool giants for lithium battery companies Very picky, not only need to have a certain scale in production capacity, but also need to have mature high-nickel cylinder NCM811 and NCA production process in R&D and technical strength. Therefore, for enterprises that want to transform into the lithium battery market of power tools, it is difficult to enter the supply chain system of international power tool giants without technical reserves.

In general, before 2025, the application of lithium batteries in power tools will grow rapidly. Whoever can take the lead in this market segment will be able to survive the accelerated reshuffle of power battery companies.